Intelligence to prevent loss

Understanding Ecommerce Chargebacks: A Complete Guide

What Ecommerce Business owners should know.

What Ecommerce Business owners should know.

Chargebacks happen when debit and credit card issuers reverse transactions as a result of successful consumer disputes. The card issuers attach a fee on top of the reversal that is referred to as a “chargeback.”

Originally created as a way to protect consumers from fraud, chargebacks and their subsequent costs have become problematic for ecommerce companies, especially small and midsize companies that rely heavily on every dollar of revenue. The time spent managing and disputing chargebacks can be considerable, which further contributes to losses.

Chargebacks fall into four categories based on why they were requested by the customer. These include:

Cardholders who are victims of account takeover (ATO) or some other type of card-not-present (CNP) fraud often file a dispute with their credit card company when they discover the issue. Online fraud has become a much bigger problem since the pandemic and is expected to cost businesses US$40 billion by 2027.

In some cases, customers make honest mistakes and file a dispute for any number of reasons, such as not recognizing the company’s name on their statement or forgetting about a recurring charge, such as a subscription. Instead of contacting the business directly, consumers contest the charge directly with their card issuer. This type of “friendly” fraud is not necessarily malicious, but it has become increasingly common.

“Friendly fraud chargebacks have increased by 15%-20% across almost all types of businesses. This is partly because card-issuing banks have made it very easy for cardholders to make their disputes and certain social media influencers have highlighted the advantages of chargebacks.”

Chris Ballenger

VP ChargebackOps

In other situations, the customer receives the purchased product and still files a dispute. This is referred to as chargeback fraud and can include any of the following scenarios:

The customer experiences buyer’s remorse for a high-priced purchase but is embarrassed to give that reason for a return.

The customer is hiding a purchase from their partner or joint account holder.

The customer wants to lower their credit card balance.

The customer forgets to cancel a recurring purchase.

The customer misses the time window to return a product.

The customer simply takes advantage of the chargeback process with the intent of getting free products.

A whopping 86% of chargebacks are deemed fraudulent. Worse, 40% of customers who file one fraudulent chargeback will file another within 90 days.

Chargeback fraud has become so pervasive, the FBI views it among the largest problems in ecommerce. Why? Because they hit businesses in the bottom line.

When businesses don’t obtain proper authorization for a transaction, don’t submit a valid authorization approval, or don’t submit a verifiable authorization, they may be subject to a chargeback from their credit card partner.

Sometimes, cardholders don’t dispute a purchase, but they do claim that the business didn’t fulfill their end of the transaction. These types of processing errors include:

A cardholder authorized a transaction but didn’t receive the goods or services from the business.

The consumer cancels a recurring transaction, but the business doesn’t process the cancellation.

A transaction charge was processed more than once.

A customer returns an order, but the business doesn’t refund the credit card.

The transaction amount the business submits differs from the amount the cardholder agreed to.

Some businesses believe chargebacks are an inevitable inconvenience. What they may not realize is that each chargeback costs far more than just the product itself or the chargeback fee they’re assessed.

Chargebacks cost online businesses around $125 billion, with every $100 lost in chargebacks translating to $240 in actual losses. Here are just a few of the fees a company incurs each time they’re hit with a chargeback:

Credit card issuers charge businesses a fee for each transaction processed, which includes the wholesale cost of the transaction plus the processor’s rate markup. If a transaction results in a chargeback, the business will lose the processing fees associated with that transaction.

Along with the chargeback, card issuers assess a chargeback fee – often ranging from $20-$100 – to cover the costs incurred during the chargeback process. That fee increases in proportion with the client’s assessed risk. And, even if a business wins a chargeback dispute and recovers the lost revenue, the card issuer won’t refund the chargeback fees.

Chargeback processing time ranges between six weeks and six months, so businesses also find themselves paying out the operational costs associated with a transaction. Some of these costs include:

Good customers don’t come easily or cheaply. Many ecommerce businesses invest significant amounts of money into marketing and advertising – sometimes up to 40% of their revenue. And that can be money wasted when transactions result in chargebacks and negative social media attention.

Card issuers measure chargeback rates by tracking raw numbers and what’s called a chargeback ratio – the number of chargebacks in a single month divided by the total number of transactions in the same month. Processors set limits, or thresholds, that determine how they will respond to high chargeback rates, including chargeback monitoring programs with high fees and consequences.

Chargeback monitoring programs are created by card issuers to protect their brand reputation and help minimize the damaging effects chargebacks can have on individual businesses. A good example of these programs is the new Visa Chargeback Monitoring Program, which combines its previously established U.S. Merchant Chargeback Monitoring Program and Global Merchant Chargeback Monitoring Program.

The Visa Chargeback Monitoring Program incentivizes businesses with chargeback problems and those identified as “high risk” to reduce their chargeback rates. When a business surpasses more than 100 chargebacks monthly and a ratio of more than 1%, Visa automatically enrolls the merchant in the program. Then Visa closely monitors the business’s chargeback levels and encourages the business to improve their fraud controls and daily operations.

Alternative payment processors have also developed their own chargeback monitoring programs. Businesses should know they can be subject to these programs from Amazon Pay, Klarna, Affirm and more.

Businesses are typically subject to chargeback monitoring programs for two to three months, so graduating out of them is not easy. First, businesses have to develop and submit a chargeback mitigation plan for approval by the card issuer. The plan must outline the key chargeback sources and offer a solution for reducing them.

Once businesses have reached the end of the program’s initial enforcement period, they have to keep their chargeback ratios below acceptable levels for three additional, consecutive months. Only then can they leave the program.

And if those businesses are unable to control their chargeback levels for 12 months after leaving the program, they may find themselves disqualified from accepting the card issuer’s payments at all. This can mean the end of a small or midsize business and is a reason for disputing chargebacks when possible.

Every ecommerce business should have a strategy for winning chargeback disputes that includes the following best practices:

Every chargeback is assigned a reason code that represents what the customer reported when filing the dispute. These codes help businesses understand why the chargeback was filed and the type of compelling evidence required for a successful chargeback reversal.

Reason codes are also helpful when businesses compile data about their chargebacks. They can identify patterns like:

Which transactions have the potential to affect their revenue?

Which codes their product or service line tends to trigger most frequently?

Which chargebacks are happening more often?

When do chargebacks typically take place the most?

Identifying these patterns helps prevent and defend against future chargebacks.

Part of the chargeback process involves businesses submitting compelling evidence to prove the validity of the transaction in question. The majority of this evidence comes from business records, such as sales receipts, order forms and tracking numbers, but there is a host of other information that companies should maintain and organize as a precaution. It’s important to note that compelling evidence can vary by industry.

The most important piece of evidence a business needs for a chargeback pertaining to physical goods is proof of delivery. It’s even more compelling when the customer has signed for the delivery. Examples of compelling evidence:

Proving that a digital product or subscription transaction is valid can be more challenging because there are so many variables involved. The most important data to maintain when preventing chargeback risks for virtual items is the customer’s IP address. This also helps to track down criminals in the event the purchase was made fraudulently. Examples of compelling evidence:

Travel industry chargebacks and chargebacks for other similar services can be difficult to combat, but they’re not impossible. Examples of compelling evidence:

“Not every merchant is the same, and not every chargeback should be responded to in the same way. Businesses should consider creating response templates specific to chargeback reason codes, the type of sale and the card issuer.”

Chris Ballenger,

VP ChargebackOps

Pay attention to behavior patterns, such as the same customer filing multiple chargebacks and their success rate. If businesses can find evidence these customers habitually file chargebacks - and lose in representment - this can bolster the case for fraudulent chargebacks. Also look at specific addresses associated with multiple chargebacks, or even time of year. Not only can this help businesses detect potential fraud, but the data gathered may also be useful to submit to the card issuer as evidence.

While the compelling evidence is important, a carefully constructed rebuttal letter offers the opportunity to succinctly summarize the key facts that can help businesses win chargeback reversals.

Here are some tips for constructing a compelling rebuttal letter:

Card issuers give customers considerable time to file a dispute, many times up to 120 days in the United States and even longer in other parts of the world like the United Kingdom, Asia and Europe. Businesses have a much shorter window to respond, and those response timeframes vary by payment platform:

Visa gives merchants 30 days to respond

PayPal only allows merchants 10 days to respond

MasterCard gives merchants 45 days to respond

American Express gives merchants 20 days to respond

Discover gives merchants 20 days to respond

In the past, when companies failed to respond promptly, credit card issuers would simply assume the merchant accepted the chargeback. But some card issuers charge additional fines if businesses don’t submit a formal response either accepting or denying the charge.

Ultimately, the best way to handle chargebacks is to prevent them from happening in the first place.

Companies need to put themselves in their customers’ shoes and anticipate how they might misread and misunderstand the purchase process.

Customers remember a great first impression. Make the shopping experience memorable and foster trust so customers will default to asking questions about a purchase instead of disputing a charge.

The best way to make sure a customer remembers they made a purchase is to send multiple confirmations, especially through the channel they prefer. Include email, text and in-app confirmations, if possible.

Shipping and delivery are big issues with customers. If they don’t know when to expect their products or they expected their products sooner, there’s a higher likelihood that they’ll assume the worst. Make sure to provide clear expectations about delivery dates to give customers peace of mind.

High-value items are among the most likely to be stolen or be involved in a fraud scheme. By requiring signatures for deliveries, especially high-value orders, companies can make it harder for a customer to deny receipt.

Offer multiple ways for customers to get in touch - phone numbers, email addresses, social media pages, chatbots - and make sure customer service can handle complaints efficiently.

Consider the business name that displays on a customer’s bank or credit card statement. Ensure the description won’t confuse customers - at the very least, let customers know what name they should expect to see on statements.

From the time the order is placed to when customers receive satisfaction surveys, stay in contact. Send order updates with shipping and tracking information so customers know where their merchandise is every step of the way.

Consider offering multiple ways for customers to contact customer service at any time - like via chatbots, email or telephone - and then ensure a representative reaches back out in a timely fashion.

Make sure that customers can easily find cancellation, refund and return policies, as well as shipping information. These should be clearly stated on the website, receipts, emails and texts - and even consider pop-up notifications as they apply.

Because it’s important for merchants to have proof that customers received, accessed and downloaded a digital product, consider providing customers with a unique product key that they’ll need to enter to download their digital purchases.

Review product descriptions to make sure they’re clear and accurate. Invest in high-definition photos of products with 360-degree views and the ability to zoom in to see details. Any place where there is even a potential for misunderstanding should be examined and clarified.

Great customer service isn’t about just being accessible; it’s also about addressing customers’ concerns - even if it means refunding the purchase to avoid a costly chargeback. Establish a flexible return policy that’s fair to both businesses and consumers, and then communicate it - on product pages, transaction confirmations and email communications.

Our massive transaction database is constantly learning as more orders are processed, and we can see the impact fraud has on diverse markets. This makes it easier for us to identify fraud trends as soon as they emerge and use those insights to make more accurate decisions.

All orders are screened using artificial intelligence and machine learning to process transactions and fine-tune fraud models based on customer behavior. Each order is assigned a fraud score. Orders with a score that meets customer-specific thresholds are automatically approved. Orders with a score that makes them questionable or suspicious are flagged for further review.

Alternative payment processors have also developed their own chargeback monitoring programs. Businesses should know they can be subject to these programs from Amazon Pay, Klarna, Affirm and more.

Our data scientists and fraud analysts perform secondary reviews of suspicious and questionable orders. They use their expertise and understanding of fraud trends – while sharing that information with the client’s team – to determine if a transaction is valid or not. And, if a company so chooses, our analysts can pleasantly and very diplomatically reach out directly to customers to confirm they made the purchase - all the while, training your team to do the same.

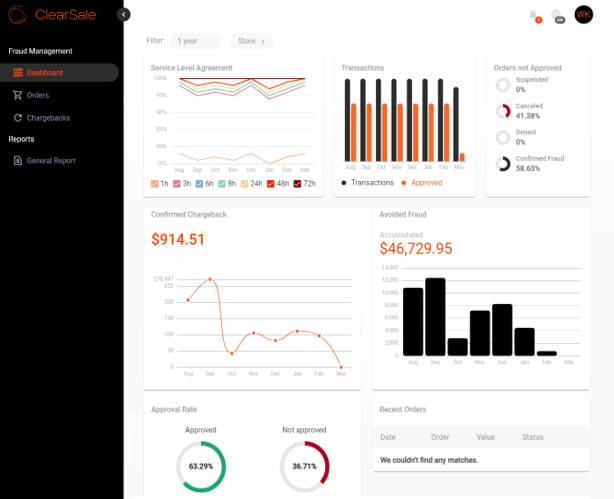

An interactive dashboard allows clients to review all orders and contribute to contextual review with information about VIP clients and orders that should be automatically approved in the future. Clients also utilize the dashboard to track chargebacks on approved orders, making it easier for ClearSale’s end-to-end chargeback management team to dispute and deliver a resolution.

Machine learning/AI can also be used post-processing to validate decisions and help find patterns to be aware of moving forward. For instance, our auditing program offers a safe test environment where we analyze random sets of declined transactions to see what would have happened if we had approved the orders. This enables us to measure the accuracy of our clients’ automated rules and fine-tune them as needed.

Through our partnership with enterprise chargeback management service provider ChargebackOps, ClearSale offers full-scale chargeback management:

Total Chargeback Protection allows businesses to recoup a portion of losses due to fraudulent transactions.

Chargeback Guarantee reimburses the transaction amount plus the chargeback amount for any unauthorized transaction that’s approved.

End-to-End Chargeback Management delivers comprehensive chargeback mitigation and resolution services, including team training, data audits and timely responses to issuers.

Learn more about chargebacks

Learn more about chargebacks

Explore even more resources about chargebacks, fraud management and ecommerce strategies.